Discover the advantages of moving to and investing in the real estate in Portugal at this Webinar, organised by the Polish – Portuguese Chamber of Commerce, featuring interventions from experts from RFF Advogados and NEWCO Corporate Services.

The webinar will be held on 27th September 2023 from 9.30 am till 10.30 CET on the Zoom platform.

✍️Click here to register for the webinar

Description:

Portugal has become very attractive both for individual clients and for foreign investors who willingly locate their investment projects here. The number of Poles residing in Portugal is increasing year by year, thanks to direct flights from Poland and the belief that Portugal is a safe country with a pleasant climate and modern bureaucracy that facilitates the process of purchasing real estate. If you want to learn more about the advantages of investing in Portugal, take part in our webinar.

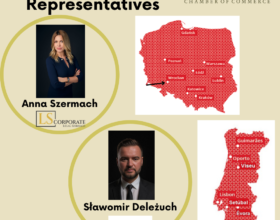

About the speakers:

🗸 Rogério Fernandes Ferreira – Founder and Managing Partner of RFF Lawyers – Tax & Business. He is Chairman of the Portuguese branches of the International Fiscal Association (IFA) and the Instituto Latinoamericano de Derecho Tributário (ILADT), former Secretary of State for Tax Affairs, and professor of Tax Law at the University of Lisbon and the Catholic University of Portugal.

🗸 Roberto Castro Mendonça – Lawyer at NEWCO, where he joined after several years of experience in law firms in Lisbon and Luxembourg. He is active in all areas of tax law and is the author of several tax-related publications, as well as the local correspondent for IBFD (International Bureau of Fiscal Documentation).

Programme of the webinar:

9:30 – 9:40 Introduction & Real Estate market outlook

9:40 – 10:00 The special tax regime for non-habitual residents (NHR)

10:00 – 10:20 Acquiring Real Estate in Portugal – what do I need to know?

Taxes upon the acquisition

Taxes during the holding period

- Taxation of long-term rental (residents and non-residents)

- Taxation of short-term rental (residents and non-residents)

- Taxes on the sale of real estate

10:20 – 10:30 Q&A Session

✍️Click here to register for the webinar