Bank Millennium is celebrating half million Konto 360°accounts

Since its launch in May 2014, Konto 360° accounts have enjoyed unyielding interest of our Clients. Number of Konto 360° accounts at our bank has just exceeded half of a million. The person who opened the five-hundred thousandth account received from the bank a very special present – for the upcoming year, every month the bank will transfer onto this newly opened account 360 PLN.

– For me and our clients, half million accounts means half million reasons for joy and celebration. Konto 360° account continues to be the most popular and most frequently opened account at our bank. It has been particularly liked by those from medium-sized and large cities, with more-than average income, who appreciate free-of-charge ATM service in Poland and abroad, low costs and perfect online and mobile banking. Konto 360°account holders are highly active – 97% of them use their account card, their lion’s part make online transactions and one third uses our mobile application. Also Blik payments and transfers to e-mail and mobile phones are increasingly more popular. – says Przemysław Dukiel, Head of the Current Accounts Sub-unit at Bank Millennium.

Konto 360º account is an offer for the entire family. Apart from standard account there are also special versions geared to the needs of the young: Konto 360º Junior account for children and youth up to 18 years of age and Konto 360º Student account for those aged 18-26 years. Account fees have been limited down to zero and they are as follows:

- 0 PLN account fee,

- 0 PLN card fee,

- 0 PLN for ATM withdrawals.

They are guaranteed upon joint fulfilment of two simple conditions. You just need total account deposits of minimum 1000 PLN and at least 1 payment with your account card or BLIK a month, and for Konto 360º Junior and Student accounts – 1 payment with your account card or BLIK a month. Moreover, irrespective of fulfilment of these conditions, clients pay 0 PLN for standing orders and direct debits, 0 PLN for domestic PLN online and mobile transfers and 0 PLN for e-mail or transfers to mobile phones.

For more information about Konto 360º account offer visit Bank Millennium branches across Poland, call our TeleMillennium info-line (801 331 331) or go to www.bankmillennium.pl.

SPCG has advised PRA Group, the world leader in acquisition and management of non-performing debt portfolios, in the transaction of DTP S.A. share acquisition.

SPCG has advised PRA Group, the world leader in acquisition and management of non-performing debt portfolios, whose parent company – PRA Group Inc. – is an American company listed on Nasdaq, on the acquisition transaction of shares of the company – DTP S.A. listed on the Warsaw Stock Exchange S.A.

PRA Group has been present on the Polish market since 2014. The acquisition of DTP S.A. shares is part of the PRA Group long-term strategy to expand the presence on the Polish market.

SPCG has worked on the complex transaction management, which covered, among other things, DTP S.A. due diligence, negotiations with the previous shareholders of the company, and the advice when the tender offer for the sale of 100% of DTP S.A. shares was announced and the representation in the proceedings before the President of The Office of Competition and Consumer Protection.

PRA Group has acquired 99,73% of DTP S.A. shares for the total amount of PLN 174,5m, as a result of the successful completion of the tender offer.

SPCG Partner Artur Zapała was involved in the transaction with the support of Of Counsel Ewa Mazurkiewicz, Associates: Agnieszka Kołodziej – Arendarska and Agnieszka Zelek, and Junior Associate Hubert Andziak. SPCG Partner Wawrzyniec Rajchel was involved in the proceedings for the granting of approval of the President of The Office of Competition and Consumer Protection.

Millennium Leasing and MOTO Flota signed a cooperation agreement

At the end of March Millennium Leasing and MOTO Flota concluded a cooperation agreement. Following the joint agreement, AutoKomfort+ service was developed, to be available already from June for Millennium Leasing clients financing passenger cars and trucks up to 3,5 t.

AutoKomfort+ service, i.e. convenient, fast and economical management of company’s car fleet is a solution with tangible benefits for clients. Activation of the service will support cost reduction and increased control over the process of vehicle maintenance. The use of the service is simple and transparent. Clients will get an access to wholesale purchases of automotive parts and maintenance services at attractive, discount prices – fixed all over Poland. They will be supported by a call centre providing advisory services in management of even a small fleet of vehicles. Celebrating the 25th anniversary of Millennium Leasing’s presence on the market, until the end of 2016 clients will be able to try out the service free of charge.

The cooperation agreement was concluded by Wojciech Rybak, Chairman of Millennium Leasing and Adam Kapek, Chairman of MOTO Flota company. – We have responded to the needs of our clients. The clients themselves told us what they need in their every-day work – said Wojciech Rybak, Chairman of the Management Board of Millennium Leasing. The new product that we are launching in a joint effort with Millennium Leasing, is a perfect opportunity to extend our services to the new client group – said Adam Kapek, Chairman of the Management Board of MOTO Flota.

MOTO Flota is one of the market leaders providing innovative fleet management services to business clients and leading CFM companies in Poland. The company belongs to Moto-Profil Group – the main distributor of automotive parts in Poland. In their operations, the companies are first and foremost focussed on loyalty to their commercial partners and on-time deliveries.

For many years, Millennium Leasing has been offering lease financing for majority of sectors in Poland. The Company is an active member of the Polish Leasing Association and one of the first lease companies on the Polish market.

Forex Trader in Bank Millennium’s mobile application

Yet again Bank Millennium introduces a modern and advanced technological tool that will provide corporate clients with convenient access to the FX market on Android or IOS based mobile devices. Mobile Millennium Forex Trader will hit the shops by the end of April.

– Entrepreneurs travel a lot and are highly mobile, so they need an application that will help them to constantly control their company’s finances. FX market is a material part of business and profitable currency exchange requires fast response. Extension of the application by adding mobile Millennium Forex Trader will enable entrepreneurs to track the FX rates and exchange currencies at the most favourable moment, irrespective of the circumstances and your location. – says Ricardo Campos, Director of the Electronic Banking Department at Bank Millennium.

Mobile Millennium Forex Trader – benefits

- Convenience and control – providing clients with full control over the course of FX transactions and company’s FX position. On your mobile’s display you may watch fluctuating FX rates and buy or sell currencies at the best time you choose.

- Speed and saving – minimisation of the time required for transaction execution and related costs. Transactions are concluded at current market FX rates. In order to conclude a transaction, you do not need to contact bank dealer or lose time for FX rate negotiation for each transaction.

- Monitoring current FX rates

- Concluding Spot and Forward transactions

- Broad choice of currencies on which you may make transactions

- The best market transaction prices even for small values

- View of the transaction history

Bank Millennium prepared also a number of improvements in the Millenet online banking system. Corporate clients with preliminary credit decision may now apply at Millenet for a charge card. The entire process, starting from granting the limit, to application registration and finally to card production is automated, which significantly shortens the waiting time to receive plastic card. It is yet another innovative solution launched by Bank Millennium on the Polish market – as the process of automated granting the limits for companies is much more complicated than for individual clients.

Also performing transactions is more convenient. Revamped and even more modern “Payment” section was designed on the grounds of the best “user experience” practices. The project took into account clients opinions and therefore it is even better adjusted to their needs. Now, use of default values, personal settings or performing transfers require lower involvement of clients. Thus, it is even faster and easier.

Good start of Millennium Leasing in 2016

In Q 1 2016, company Millennium Leasing concluded lease agreements worth more than 856 million PLN. The company recorded a very good growth of 44% y/y in financing movable assets, including 117% y/y growth in heavy transport vehicles.

– We have ambitious goals for 2016. The beginning of the year has been a good sign for their fulfilment, so such good results in the first quarter are for us a strong motivation for intensive work in the next months. Close to 93% our clients are SMEs. We are changing our product offer for them and working for even better quality of services. The results have shown that we chose a good development direction which we will continue in the longer-term. – says Wojciech Rybak, Chairman of the Management Board of Millennium Leasing.

In Q 1 2016, the value of the assets financed within the road vehicle group totalled more than 585 million PLN. In the heavy transport category the value of financed assets totalled 407 million PLN, which means 117% growth versus the same period last year. As part of this category, the company recorded significant growth in the following groups: trucks above 3,5 t – 384%, tractor units – 28%, semi-trailers and trailers – 21%, and buses – 748%.

In Q 1 2016, the value of the assets from the light vehicle category totalled more than

155 million PLN, which means 8,1% growth versus the same period last year. The value of the financed industrial machines and equipment reached almost 250 million PLN, i.e. 12% growth y/y.

Millennium Leasing has been offering lease financing for the majority of industries in Poland for years now. The company is an active member of the Polish Leasing Association and one of the first lease companies established on the Polish market.

OECD Report – Poland: Investment in infrastructure and skills will support higher living standards and greater well-being

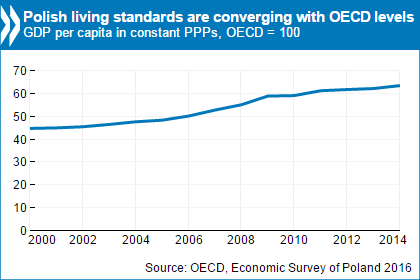

Polish economic growth remains solid and unemployment is decreasing, but further investments in infrastructure and skills will be essential to sustain a continuing improvement in living standards, environmental quality and well-being, according to the latest OECD Economic Survey of Poland.

The Survey, presented in Warsaw today by OECD Chief Economist Catherine L. Mann and Poland’s Deputy Prime Minister Mateusz Morawiecki, marks the 20th anniversary since Poland joined the OECD. It underlines the tremendous progress made toward convergence with higher-income countries over the past two decades, but also points out the challenges remaining to, strengthen employment and job quality, improve the business environment and boost infrastructure, as well as ensure sound public finances.

“Poland has made remarkable progress over the 20 years since it joined the OECD, delivering levels of well-being and quality of life that have never before been experienced,” Ms Mann said. “During the time when most countries have been struggling to bounce back from the global economic crisis, the Polish economy has reported strong growth, driving down unemployment. The challenge going forward is to find the policy mix to promote the transition to an economy based on higher technologies and skills, making growth stronger, greener and more inclusive.”

This reform agenda and the new government’s policy priorities – including a new child benefit – involve higher spending. To help finance this, the Survey proposes options for wide-ranging tax reform, including the withdrawal of reduced VAT rates and exemptions, increased use of property and green taxes and strengthening the tax administration. Boosting skills will lead to higher productivity and employment growth, according to the Survey. Continuing the expansion of access to early childhood education, strengthening support for weaker students and better integrating workplace training into vocational education will be key.

Better opportunities to combine professional and family lives are needed to allow more women into the workforce. In addition to more childcare facilities, long-term care services are also needed. The ongoing reform raising the statutory pension age in stages is needed to strengthen employment of seniors and avoid old-age poverty. Envisaged possibilities to retire early should be equal for men and women and should not involve financial incentives for take-up.

To improve infrastructure investment, Poland should better integrate environmental and health criteria to the project selection and evaluation process, ensure stable financing for public transport infrastructure investment and maintenance, and improve framework conditions for investment in renewable energy. Providing support to local governments running infrastructure projects and strengthening local governance capacities would improve infrastructure delivery.

Source: AICEP Portugal Global